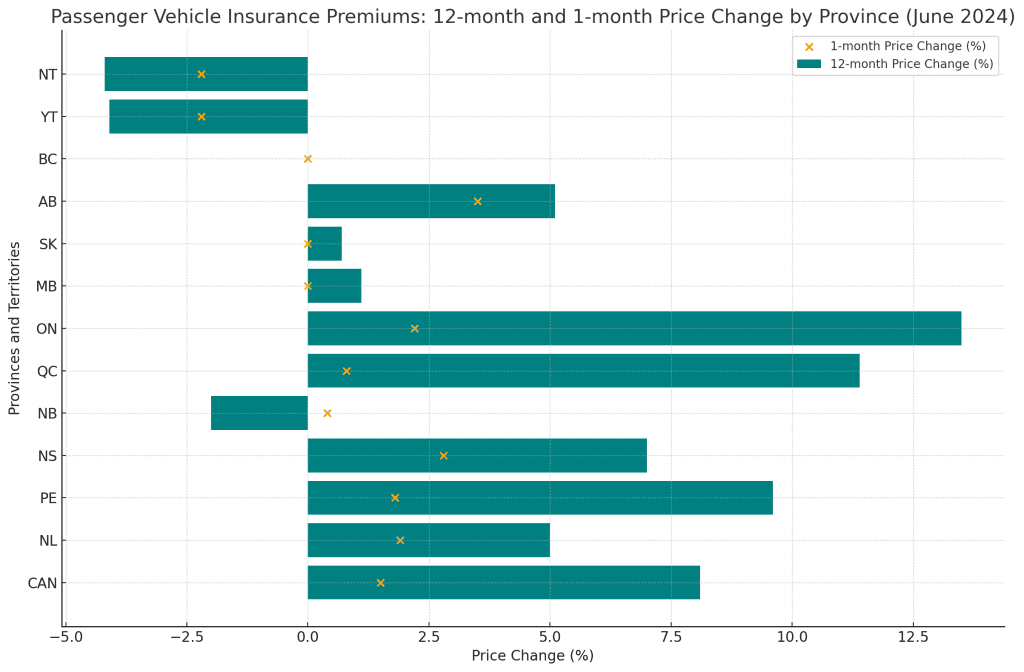

Auto Insurance Premiums Soar in Ontario and Quebec as of June 2024: A Provincial Breakdown

According to the latest Consumer Price Index (CPI) data from Statistics Canada, Ontario saw a significant 13.5% increase in premiums over the past 12 months, while Quebec reported an 11.4% rise. These figures reflect the growing financial burden on drivers in these provinces as insurance costs continue to escalate.

Provincial Comparisons: Year-over-Year and Monthly Changes

Across Canada, other provinces have also seen substantial increases in auto insurance premiums. Prince Edward Island recorded a 9.6% year-over-year increase, while Nova Scotia experienced a 7.0% rise. Newfoundland and Labrador followed with a 5.0% increase. However, New Brunswick was an outlier, with a 2.0% decrease in premiums over the past 12 months, although it saw a slight 0.4% increase in the last month.

In Alberta, auto insurance premiums increased by 5.1% over the past year, with a notable 3.5% increase in just the last month—the highest monthly jump among all provinces.

Meanwhile, Manitoba and Saskatchewan reported minimal year-over-year increases of 1.1% and 0.7%, respectively, with no change in premiums over the last month. British Columbia, despite having the highest basket weight for auto insurance premiums at 3.10%, saw no change in premiums over the past year or month.

Regions with Declining Premiums

Contrary to the overall trend, some regions experienced a decline in auto insurance premiums. Whitehorse, Yukon, and Yellowknife, Northwest Territories, saw their premiums decrease by 4.1% and 4.2%, respectively, over the past year. These territories also recorded further declines of 2.2% in the last month, highlighting a unique trend compared to the rest of Canada

The data from June 2024, sourced from Statistics Canada’s Consumer Price Index report, reveals significant inflation in auto insurance premiums across Canada, with Ontario and Quebec leading the increases. While the national average increase was 8.1%, some regions, like Alberta, are experiencing rapid monthly hikes, while others, such as British Columbia, have maintained stable premiums. Notably, the northern territories have seen declines in premiums.

It’s important to recognize that this report provides the numbers but does not delve into the reasons behind them. The factors driving these increases are complex and can include a range of issues, from increased claims and the costs associated with natural disasters to potential fraud and regulatory changes. These underlying causes require careful analysis, but the focus here is strictly on reporting the observed inflationary trends.

For more detailed information, readers can refer to the full CPI report at Statistics Canada.